All Categories

Featured

Table of Contents

When individuals state "mortgage defense life insurance policy" they tend to mean this one. With this plan, your cover amount decreases over time to mirror the reducing amount total amount you owe on your home loan.

To see if you could conserve money with reducing term life insurance coverage, demand a callback from a LifeSearch specialist today. For more details go here or see our home loan defense insurance coverage home page. Yes it does. The factor of home loan security is to cover the expense of your home loan if you're not about to pay it.

You can relax easy that if something occurs to you your home loan will certainly be paid. Life insurance policy and mortgage protection can be virtually one in the exact same.

The round figure payout mosts likely to your enjoyed ones, and they might choose not to remove the home loan with it. It depends if you still desire to leave cash for liked ones when you die. If your home loan is clear, you're greatly debt-free, and have no monetary dependents, life insurance policy or ailment cover might feel unneeded.

If you're home loan complimentary, and heading into retired life age area, it deserves looking getting recommendations. Critical illness cover could be pertinent, as can over 50s cover. It depends on the worth of your home mortgage, your age, your wellness, family size, way of living, hobbies and situations in general. While there are as well numerous variables to be precise in addressing this question, you can discover some common examples on our life insurance policy and home loan protection pages - life insurance mortgage loan.

Whether you wish to go it alone, or you intend to obtain suggestions eventually, right here's a tool to help you with points to consider and exactly how much cover you may require. Life insurance policy exists to protect you. And no two people coincide. The best policy for you depends on where you are, what's taking place in the house, your health, your strategies, your needs and your spending plan.

House Payment Insurance

This indicates that every one of the continuing to be home loan at the time of the fatality can be fully repaid. The inexpensive is because of the payout and liability to the insurer minimizing in time (mortgage life plan). In the early years, when the fatality payout would be highest, you are usually healthier and much less likely to die

The advantages are paid by the insurance policy business to either the estate or to the recipients of the individual that has died. The 'estate' is every little thing they owned and leave when they die. The 'recipients' are those qualified to a person's estate, whether a Will has been left or otherwise.

They can after that remain to stay in the home without further home loan payments. Policies can also be set up in joint names and would certainly then pay on the first death during the mortgage term. The benefit would certainly go straight to the enduring companion, not the estate of the departed person.

What Is A Mortgage Guarantee Policy

The strategy would certainly then pay the amount guaranteed upon medical diagnosis of the strategy holder enduring a severe ailment. These consist of cardiac arrest, cancer, a stroke, kidney failure, heart bypass surgical procedure, coma, complete irreversible impairment and a variety of various other major conditions. Monthly premiums are usually repaired from start for the life of the strategy.

The premiums can be affected by bad health and wellness, way of life aspects (e.g. smoking or being obese) and line of work or leisure activities. The rates of interest to be charged on the mortgage is also important. The strategies usually assure to repay the exceptional amount as long as a particular rate of interest rate is not exceeded throughout the life of the loan.

Mortgage defense strategies can provide simple protection in situation of sudden death or essential illness for the impressive home mortgage amount. This is normally the majority of people's biggest monthly economic cost (critical life cover mortgage). Nonetheless, they should not be taken into consideration as sufficient security for all of your scenarios, and various other sorts of cover may likewise be needed.

We will assess your insurance requires as part of the mortgage suggestions process. We can after that make referrals to fulfill your demands and your spending plan for life cover.

Purchase a term life insurance plan for at the very least the amount of your home mortgage. They can utilize the profits to pay off the mortgage.

Life Protection Insurance Marketing

If your mortgage has a low rate of interest price, they may want to pay off high-interest credit rating card financial obligation and keep the lower-interest home loan. Or they may want to pay for home maintenance and maintenance.

Figure out other methods that life insurance policy can help protect your and your family.

Approval is ensured, despite health and wellness if you are in between the ages of 18 and 69. No health and wellness inquiries or medical examinations. The cost effective month-to-month costs will certainly never boost for any type of reason. Fees as reduced as $5.50 each month. For every year the Policy stays continually in pressure, key insured's Principal Benefit will immediately be boosted by 5% of the Initial Principal Advantage till the Principal Advantage is equivalent to 125% of the First Principal Advantage, or the key insured turns age 70, whichever is previously. average cost of mortgage life insurance.

Company Insurance Life Mortgage

Globe Life is ranked A (Outstanding)**by A.M.

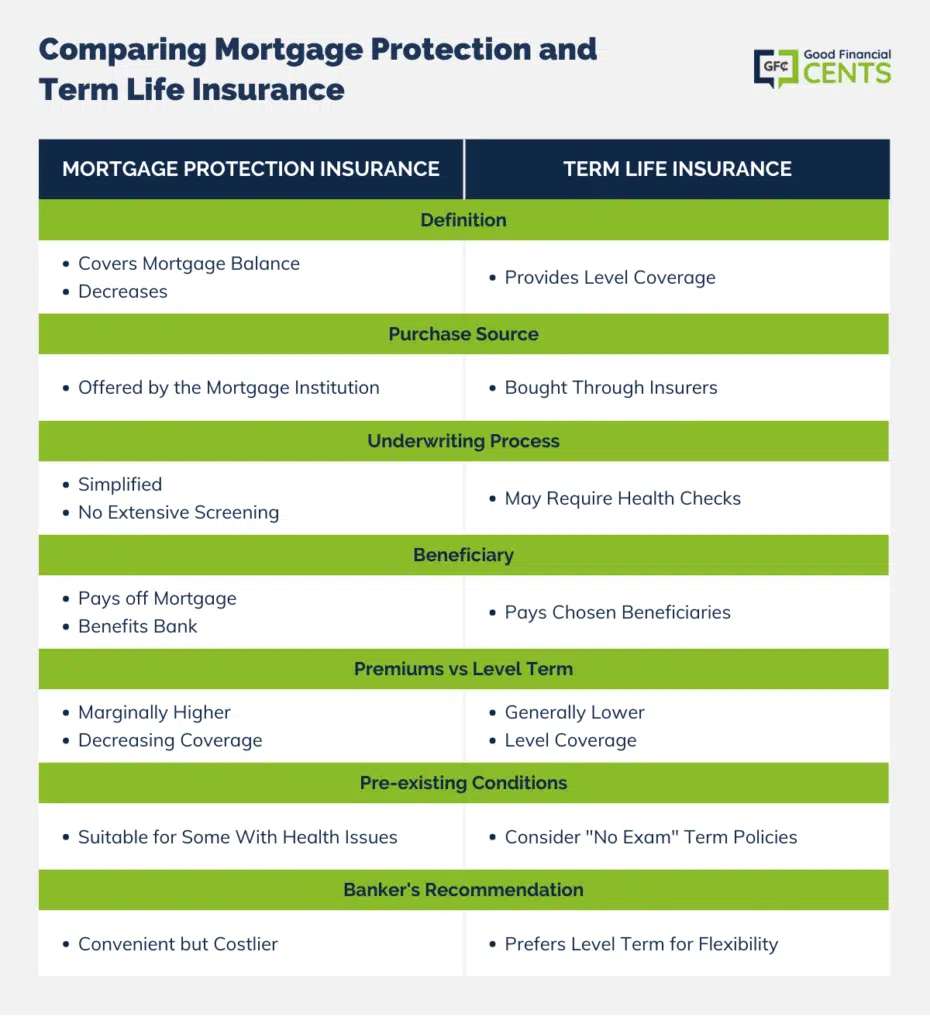

For most peopleMany term life insurance offers insurance coverage supplies coverage than MPI and can also be used to made use of off your mortgage in the event of occasion death. Mortgage life insurance is made to cover the equilibrium on your mortgage if you pass away before paying it in full. The payout from the policy decreases over time as your mortgage equilibrium goes down.

The survivor benefit from an MPI goes right to your home mortgage loan provider, not your family, so they wouldn't be able to use the payout for any kind of other financial obligations or costs. A regular term life insurance coverage. house life insurance policy permits you to cover your home loan, plus any other expenses. There are less costly alternatives readily available.

Mortgage Insurance Clause

The survivor benefit: Your MPI death benefit decreases as you pay off your home loan, while term life plans most frequently have a level death benefit. This implies that the protection quantity of term life insurance policy stays the same for the whole period plan. Home mortgage defense insurance coverage is frequently perplexed with exclusive mortgage insurance (PMI).

Nonetheless, entire life is considerably more costly than term life. "Term life is incredibly important for any kind of private they can have college car loans, they might be married and have children, they may be solitary and have bank card loans," Ruiz stated. "Term life insurance coverage makes feeling for lots of people, yet some people desire both" term life and entire life protection.

Or else, a term life insurance coverage plan likely will offer even more versatility at a cheaper price."There are people who do both [MPI and term life] since they wish to ensure that their home loan earns money off. It can also depend upon that the recipients are," Ruiz stated." [It's ultimately] as much as what kind of protection and just how much [coverage] you want - best insurance for home loan."If you're not exactly sure which sort of life insurance policy is best for your scenario, speaking to an independent broker can assist.

illness, accident, and so on. The only requirement "exclusion" is for suicide within the first 13 months of establishing the policy. Like life insurance policy, home loan security is pretty straightforward. You pick an amount to shield (typically to match your ongoing settlements), a "delay period", and a "repayment duration". If you end up being hurt or ill and can't work, when your wait duration has actually completed, your insurance firm will make regular monthly insurance claim repayments.

Table of Contents

Latest Posts

Instant Permanent Life Insurance Quotes

Funeral Covers

Funeral Cover

More

Latest Posts

Instant Permanent Life Insurance Quotes

Funeral Covers

Funeral Cover